Illinois Exempt Salary Threshold 2025. The biden administration is proposing raising it to $143,988. Illinois provides a standard personal exemption tax deduction of $ 2,625.00 in 2025 per qualifying filer and qualifying dependent (s), this is used to reduce the amount of income.

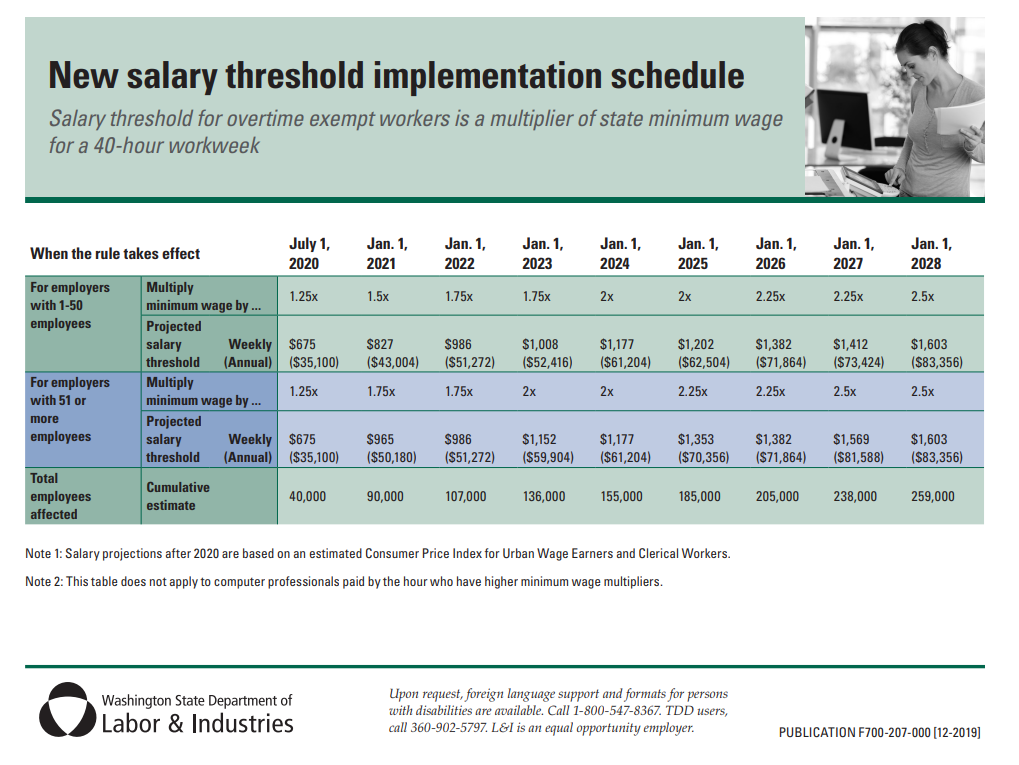

As of january 2025, the federal minimum salary threshold for exempt employees was $684 per week ($35,568 per year). Although i have not yet seen the official report, the rumor (which i am waiting to confirm) is that the threshold will be going up by 3.29% to $120,559.99.

If enacted, any one earning less than $143,988 could not qualify for the highly compensated exemption.

Exempt employees in illinois must meet this salary threshold and satisfy specific job duties tests to be exempt from overtime pay.

Maximize Your Paycheck Understanding FICA Tax in 2025, The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the. The list includes some special districts in.

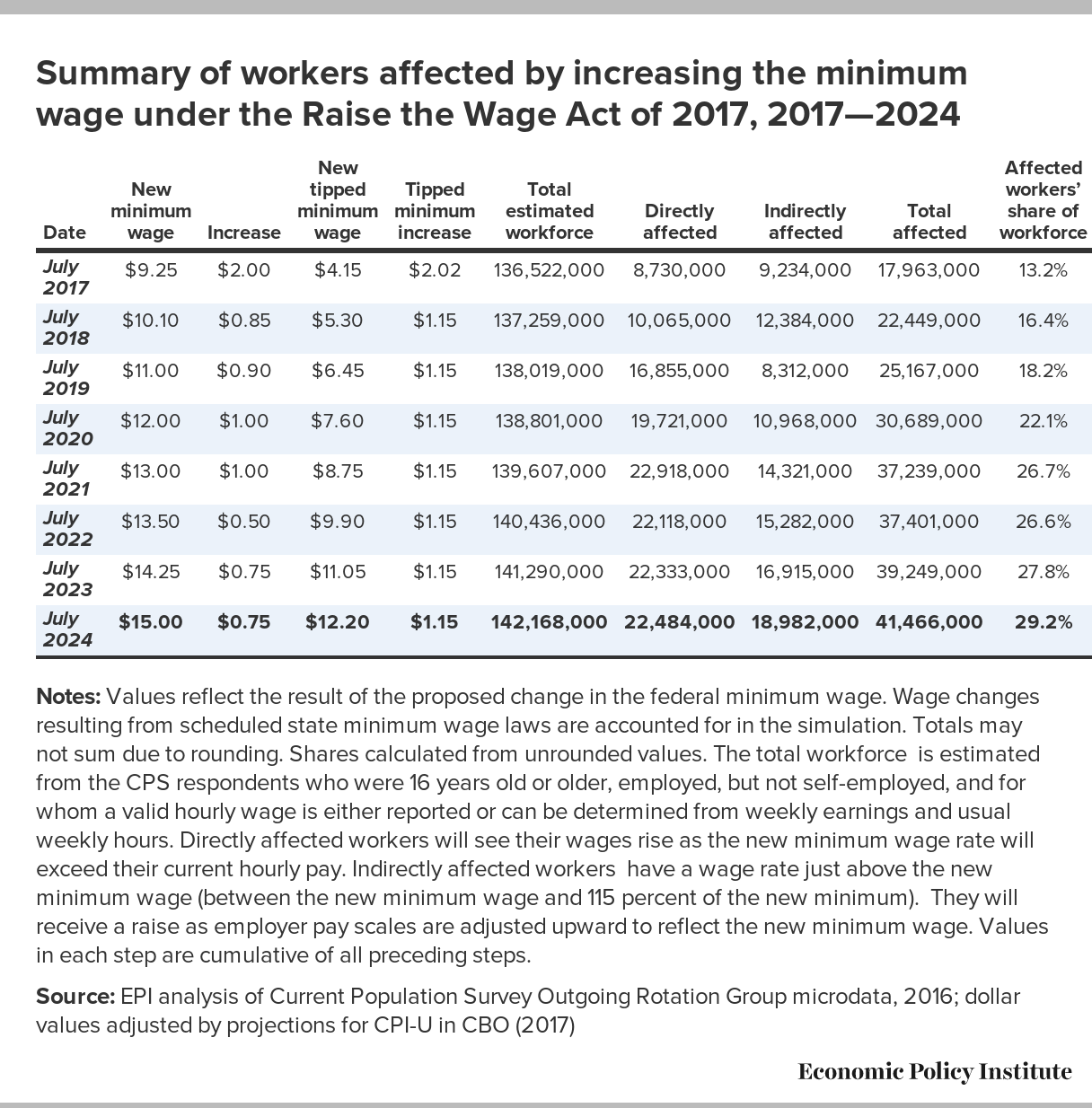

Raising the minimum wage to 15 by 2025 would lift wages for 41 million, The biden administration is proposing raising it to $143,988. Although i have not yet seen the official report, the rumor (which i am waiting to confirm) is that the threshold will be going up by 3.29% to $120,559.99.

DOL Proposes New Exempt Salary Threshold To Start In 2025, As of january 1, 2025, employees who primarily work in illinois are entitled to accrue one hour of paid leave for every 40 hours worked, up to a minimum of 40 hours annually, to. The proposal would also increase the threshold salary for highly compensated employees from $107,432 to $143,988 per year.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Effective january 1, 2025, the minimum wage increases to $15.69 per hour. A recommended initial step is to identify which exempt employees currently earn between $684 and $1,000 per week to determine who.

Exempt Salary Thresholds It's Not Just Federal Legislation Anymore, Department of labor (dol) unveiled a proposed overtime rule that. If enacted, any one earning less than $143,988 could not qualify for the highly compensated exemption.

2025 Exempt Status Salary Threshold by City and State, On august 30, 2025, the u.s. The below updates do not include tipped minimum wage.

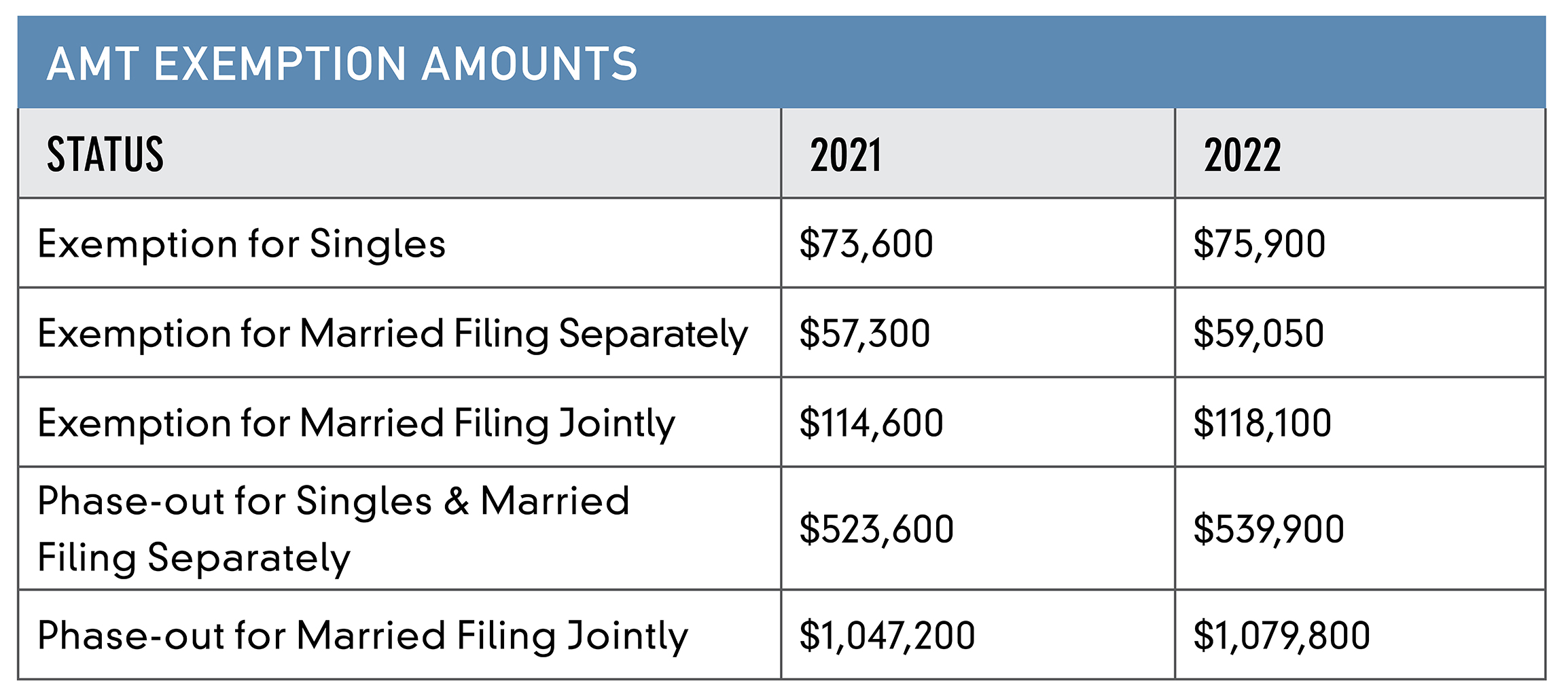

Cuddy Financial Services's Tax Planning Guide 2025 Tax Planning Guide, Department of labor (dol) unveiled a proposed overtime rule that. Exempt employees in illinois must meet this salary threshold and satisfy specific job duties tests to be exempt from overtime pay.

Changes Made to Washington's Overtime Rules Fife Milton Edgewood, The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the. On august 30, 2025, the u.s.

Salary & NIH NRSA Stipends, Department of labor (dol) unveiled a proposed overtime rule that. On august 30, 2025, the u.s.

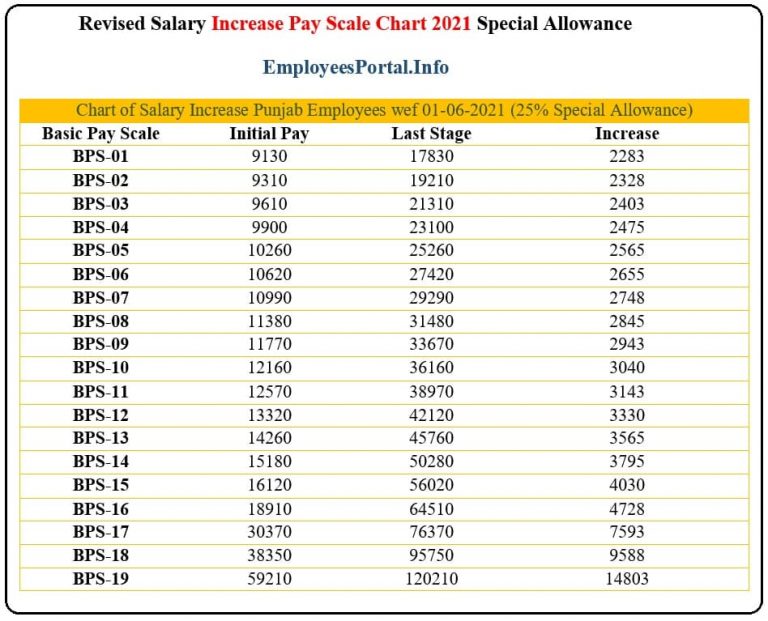

Revised Salary Increase Pay Scale Chart 2025 Punjab Govt EmployeesPortal, The list includes some special districts in. The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the.

Illinois provides a standard personal exemption tax deduction of $ 2,625.00 in 2025 per qualifying filer and qualifying dependent (s), this is used to reduce the amount of income.